-40%

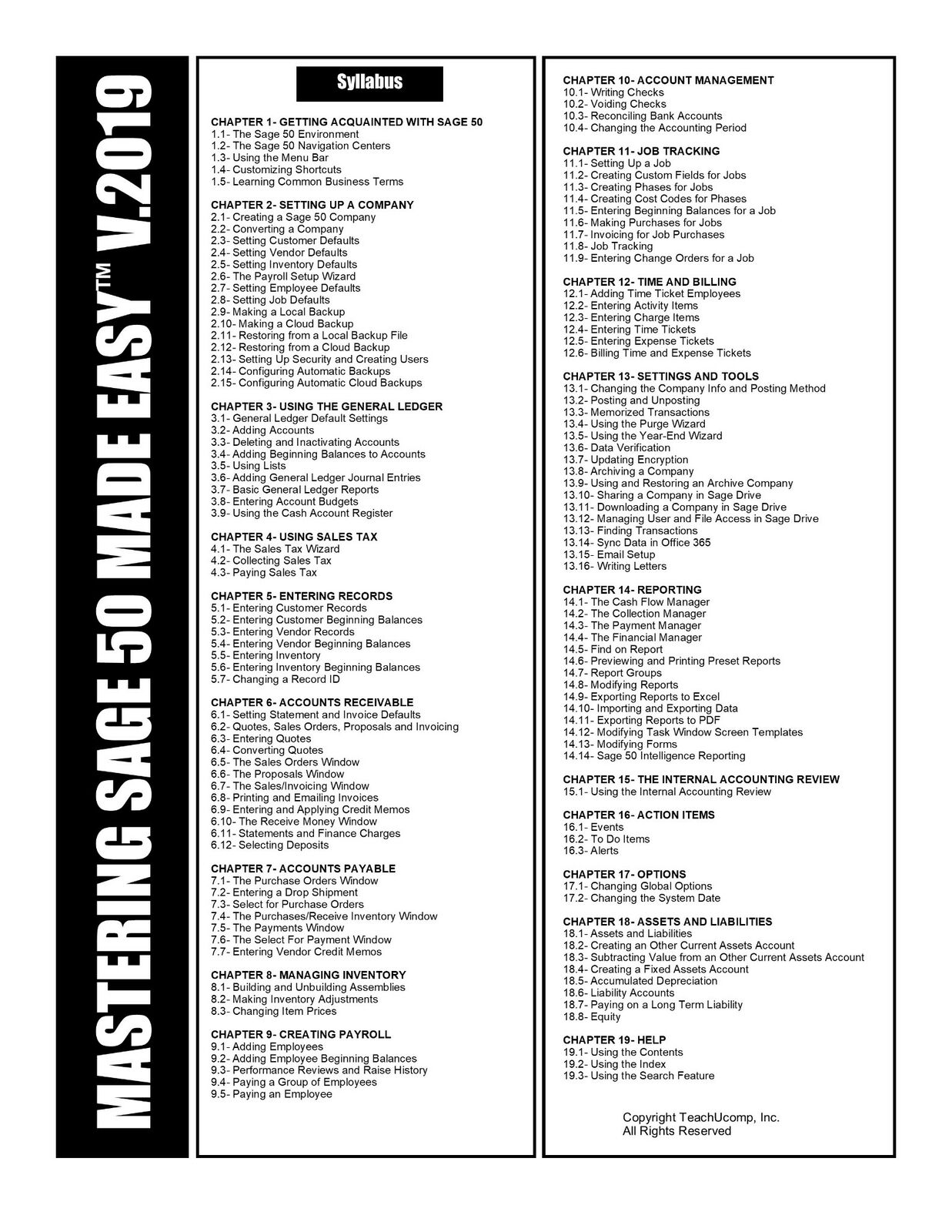

SAGE 50 ACCOUNTING 2019 DELUXE Training Tutorial Course & Quick Reference Guide

$ 17.42

- Description

- Size Guide

Description

SAGE 50 ACCOUNTING 2019 DELUXE Training Tutorial Course & Quick Reference GuideSAGE 50 ACCOUNTING 2019 DELUXE Training Tutorial Course & Quick Reference Guide

Mastering Sage 50 Made Easy DELUXE Self-Study Training Course

Product Details:

Product Name:

Mastering Sage 50 Made Easy

Manufacturer:

TeachUcomp, Inc.

Versions Covered:

2019

Course Length:

6 Hours

Video Lessons:

132

Instruction Manuals: 2

(PDF)

Practice Exam:

Included

FinalExam:

Included

Certificate of Completion:

Included

Quick Reference Guide:

4 Pages, Laminated, 75 Topics

Product Type:

DELUXE

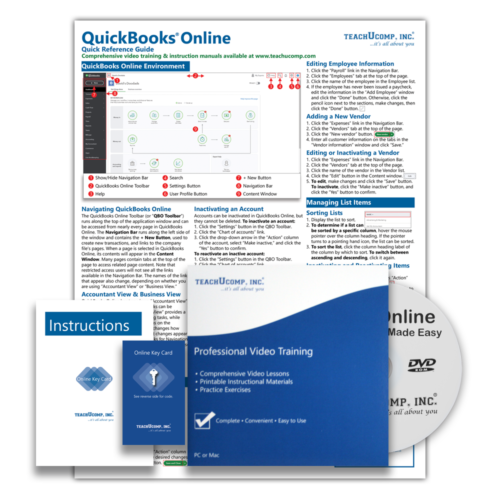

Learn Sage 50 with this Deluxe training package from TeachUcomp, Inc.

Mastering Sage 50 Made Easy Deluxe

features 132 video lessons with over 6 hours of introductory through advanced instruction on both DVD-ROM to play on your PC or Mac and via online for one year (with enclosed Online Key Code) to view the course on your computer or mobile device. In addition, you’ll get our Sage 50 2019 Quick Reference Guide- a four-page printed, laminated guide with step-by-step instructions in the most critical functions. Pop in the DVD-ROM or launch the online version to watch, listen and learn as your expert instructor guides you through each lesson step-by-step. During this media-rich learning experience, you will see each function performed just as if your instructor were there with you. Reinforce your learning with the text of our three printable classroom instruction manuals in PDF (Introductory and Advanced), additional images and practice exercises.

This package also includes an optional practice exam with evaluative feedback, an optional final exam and a Certificate of Completion when you pass the final exam. Test your knowledge after completing the course and demonstrate your proficiency.

Whether you are completely new to Sage 50 or upgrading from an older version, this course will empower you with the knowledge and skills necessary to be a proficient user. We have incorporated years of classroom training experience and teaching techniques to develop an easy-to-use course that you can customize to meet your personal learning needs.

Topics Covered:

Getting Acquainted with Sage 50

1. The Sage 50 Environment

2. The Sage 50 Navigation Centers

3. Using the Menu Bar

4. Customizing Shortcuts

5. Learning Common Business Terms

Setting Up a Company

1. Creating a Sage 50 Company

2. Converting a Company

3. Setting Customer Defaults

4. Setting Vendor Defaults

5. Setting Inventory Defaults

6. The Payroll Setup Wizard

7. Setting Employee Defaults

8. Setting Job Defaults

9. Making a Local Backup

10. Making a Cloud Backup

11. Restoring from a Local Backup File

12. Restoring from a Cloud Backup

13. Setting Up Security and Creating Users

14. Configuring Automatic Backups

15. Configuring Automatic Cloud Backups

Using the General Ledger

1. General Ledger Default Settings

2. Adding Accounts

3. Deleting and Inactivating Accounts

4. Adding Beginning Balances to Accounts

5. Using Lists

6. Adding General Journal Entries

7. Basic General Ledger Reports

8. Entering Account Budgets

9. Using the Cash Account Register

Using Sales Tax

1. The Sales Tax Wizard

2. Collecting Sales Tax

3. Paying Sales Taxes

Entering Records

1. Entering Customer Records

2. Entering Customer Beginning Balances

3. Entering Vendor Records

4. Entering Vendor Beginning Balances

5. Entering Inventory

6. Entering Inventory Beginning Balances

7. Changing a Record ID

Accounts Receivable

1. Setting Statement and Invoice Defaults

2. Quotes, Sales Orders, Proposals and Invoicing

3. Entering Quotes

4. Converting Quotes

5. The Sales Orders Window

6. The Proposals Window

7. The Sales/Invoicing Window

8. Printing and Emailing Invoices

9. Entering and Applying Credit Memos

10. The Receive Money Window

11. Statements and Finance Charges

12. Selecting Deposits

Accounts Payable

1. The Purchase Orders Window

2. Entering a Drop Shipment

3. Select for Purchase Orders

4. The Purchases/Receive Inventory Window

5. The Payments Window

6. The Select For Payment Window

7. Entering Vendor Credit Memos

Managing Inventory

1. Building and Unbuilding Assemblies

2. Making Inventory Adjustments

3. Changing Item Prices

Creating Payroll

1. Adding Employees

2. Adding Employee Beginning Balances

3. Performance Reviews and Raise History

4. Paying a Group of Employees

5. Paying an Employee

Account Management

1. Writing Checks

2. Voiding Checks

3. Reconciling Bank Accounts

4. Changing the Accounting Period

Job Tracking

1. Setting Up a Job

2. Creating Custom Fields for Jobs

3. Creating Phases for Jobs

4. Creating Cost Codes for Phases

5. Entering Beginning Balances for a Job

6. Making Purchases for a Job

7. Invoicing for Job Purchases

8. Job Tracking

9. Entering Change Orders for a Job

Time and Billing

1. Adding Time Ticket Employees

2. Entering Activity Items

3. Entering Charge Items

4. Entering Time Tickets

5. Entering Expense Tickets

6. Billing Time and Expense Tickets

Settings and Tools

1. Changing the Company Info and Posting Methods

2. Posting and Unposting

3. Memorized Transactions

4. Using the Purge Wizard

5. Using the Year-End Wizard

6. Data Verification

7. Updating Encryption

8. Archiving a Company

9. Using and Restoring an Archive Company

10. Sharing a Company in Sage Drive

11. Downloading a Company in Sage Drive

12. Managing User and File Access in Sage Drive

13. Finding Transactions

14. Sync Data in Office 365

15. Email Setup

16. Writing Letters

Reporting

1. The Cash Flow Manager

2. The Collection Manager

3. The Payment Manager

4. The Financial Manager

5. Find on Report

6. Previewing and Printing Preset Reports

7. Report Groups

8. Modifying Reports

9. Exporting Reports to Excel

10. Importing and Exporting Data

11. Exporting Reports to PDF

12. Modifying Task Window Screen Templates

13. Modifying Forms

14. Sage 50 Intelligence Reporting

The Internal Accounting Review

1. Using the Internal Accounting Review

Action Items

1. Events

2. To-Do Items

3. Alerts

Options

1. Changing Global Options

2. Changing the System Date

Assets and Liabilities

1. Assets and Liabilities

2. Creating an Other Current Assets Account

3. Subtracting Value from an Other Current Assets Account

4. Creating a Fixed Assets Account

5. Accumulated Depreciation

6. Liability Accounts

7. Paying on a Long Term Liability

8. Equity

Help

1. Using the Contents

2. Using the Index

3. Using the Search Feature

Minimum System Requirements:

1 GHz Intel Pentium Processor or equivalent

Windows or MAC

1 GB RAM

256 color SVGA capable of 1024x768 resolution

Speakers or headphones

DVD-ROM Drive

Payment

Shipping

Returns

Contact

We accept

PayPal

for all orders- the safest way to shop on eBay.

Digital Items:

No shipping means fast access to your course.

Within one business day following purchase, you will receive a message from us through the eBay messaging system that contains your login credentials and instructions to access your course from our site.

Physical Products:

We offer

FREE shipping

U.S. orders.

Your order will be shipped within 1 business day of receiving payment (Monday-Friday).

In the very unlikely event that your item is lost or damaged during shipment, please be sure to let us know. We will issue either a full refund or replacement.

If you are not 100% satisfied with your purchase, you can return the product and get a full refund (minus any shipping costs) or exchange the product for another one.

You can return a product for up to 30 days from the date you purchased it.

Any physical product you return must be in the same condition you received it and in the original sealed packaging.

Please use the eBay message center to contact us. This assures that we receive your message. We are open Monday through Friday 9-5 Eastern and will answer you within one business day.

We're always happy to answer questions. We want to make your buying experience as pleasurable as possible.

Listing and template services provided by inkFrog