-40%

Rental Income Property Analysis - Windows Excel Spreadsheet Tool

$ 29.04

- Description

- Size Guide

Description

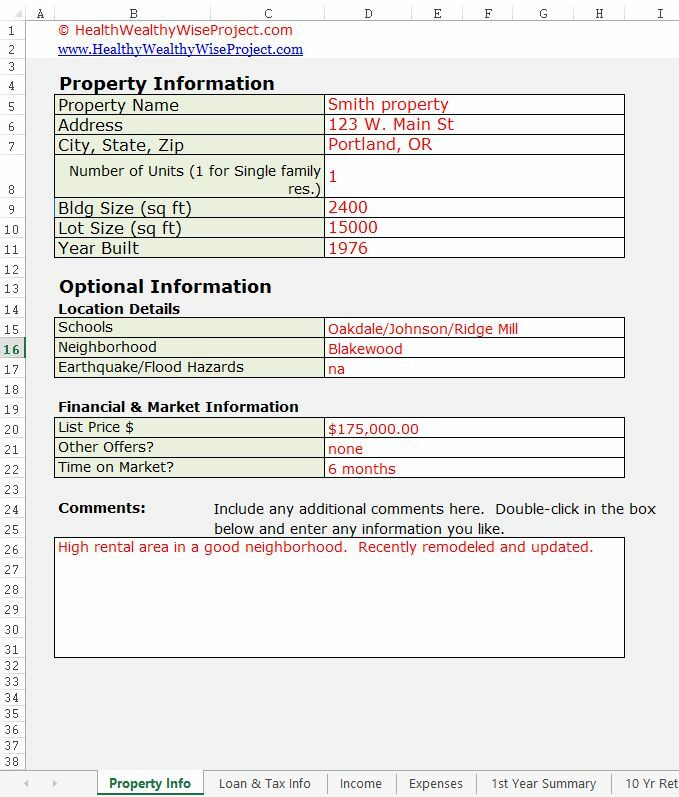

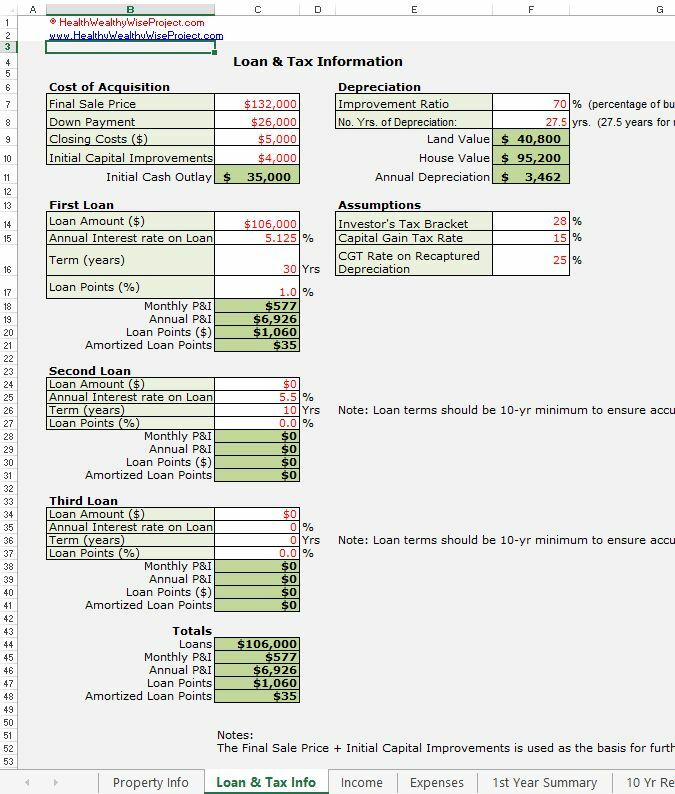

Buying a rental income property? Don't buy on hope, KNOW your rates of return, tax benefits, and cash flows BEFORE you buy. Calculate the optimal offer price. Analyze several loan options. Compare different rental investment opportunities. Rental real estate is a major investment of time and money. Invest the effort into a 10-year cash flow analysis before you buy a headache property. The program runs thru an Excel spreadsheet.Analyze cash flows, tax benefits, and investment rates of return for Rental income properties. Know the optimal offer price before you buy. Easy to use Excel spreadsheet.

Customer comments:

Thank you so much. This spreadsheet has much adoration in my community.

- Deborah [Portland,

OR]

Thanks. I really appreciate it. I respect the effort put into the development of the spreadsheet.

-

Darrell [Bellaire, TX]

Great product which has helped me in evaluating my real estate investments.

Thank you - Chris [Eagle River, AK]

NOTE: visit my website to order a direct download version from the 'Research Offers' page:

HealthyWealthyWiseProject

Perhaps you haven't thought about investing in rental real estate since the bursting of the housing bubble, but now is the time. What we have is:

* motivated Sellers

* now nearly as undervalued as it was overvalued during the recent bubble

* easy financing

* the government trying to help - low interest rates

* tax benefits, and

* positive monthly cash flow

Yes, investing in rental real estate income property could be the best investment of the next 10 years. Unlike during the bubble years, income property bought at the right price can now generate positive monthly cash flows for the investor.

B

ut how exactly do you scoop up the rental real estate bargains?

That's why I created a

real estate excel spreadsheet to analyze rental property cash flow, rate of return, and profitability quickly and easily.

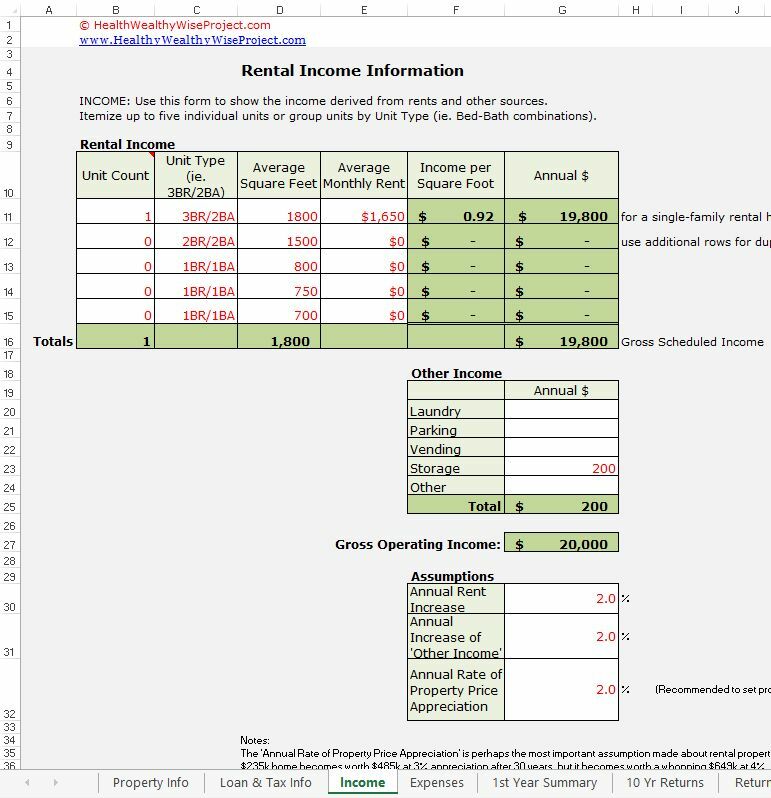

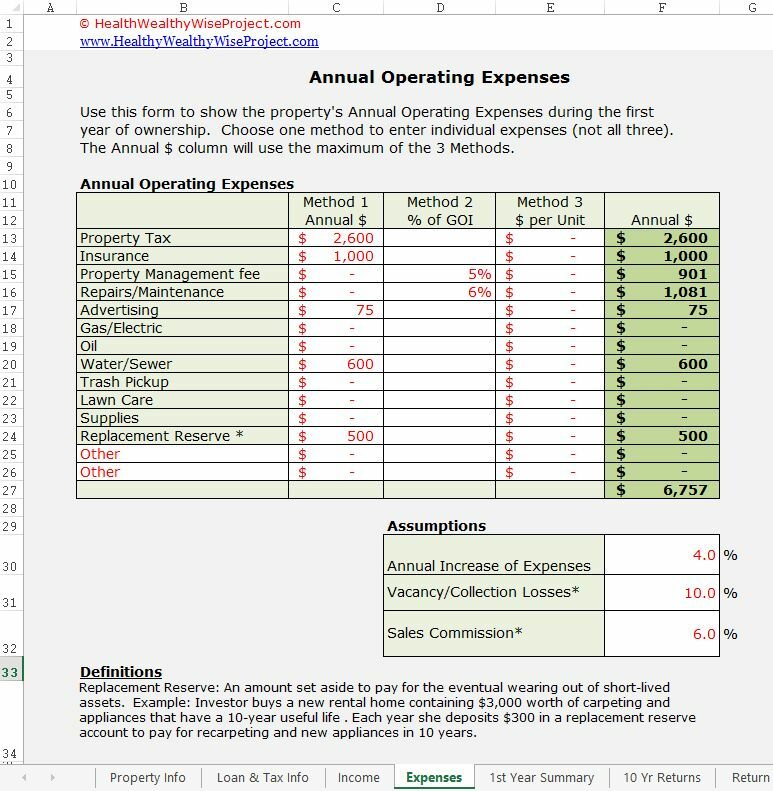

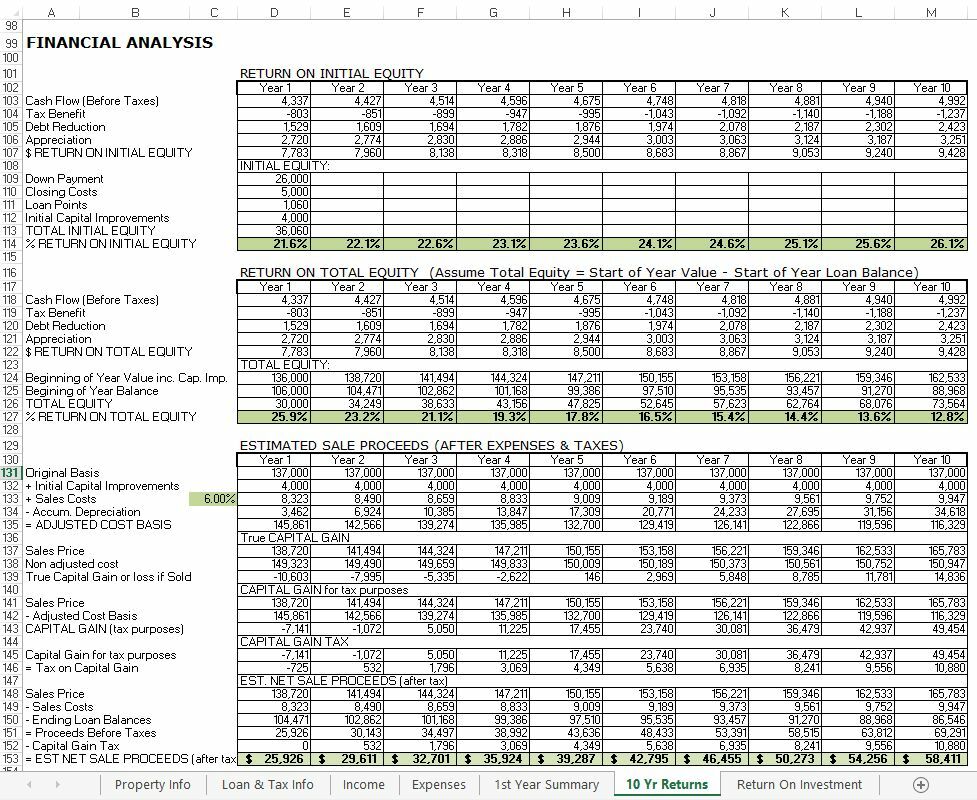

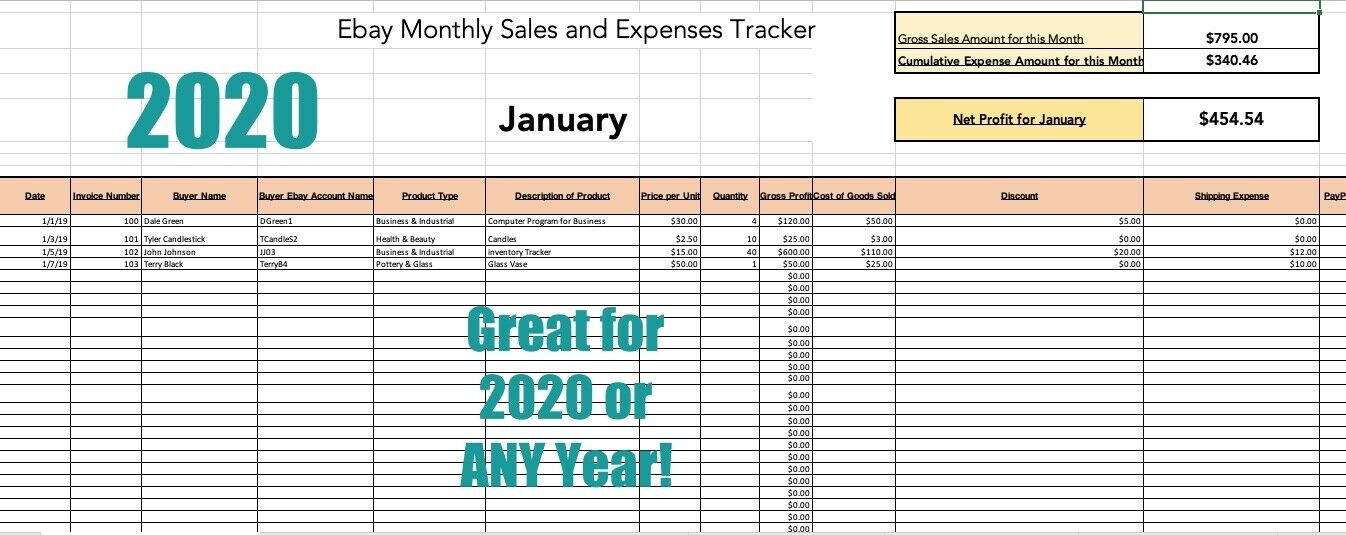

The spreadsheet can account for multiple unit types such as apartment buildings, duplexes, etc. Rental income assumptions are also entered here. This sheet calculates Gross Scheduled Income, Gross Operating Income, and provides assumptions for rent increase and property price appreciation. A full 10 years of ownership returns are provided. Items such as Effective Gross Income (EGI), Gross Operating Income (GOI), Net Operating Income (NOI), Cash flows, and tax benefits. And even more good stuff to know - including things like mortgage principal reduction, property appreciation, debt coverage ratio, as well as the estimated sale proceeds (after taxes and expenses).

You don't have to be a financial wizard, simply enter basic financial data into user-friendly forms, and the program will automatically calculate the formulas.

The spreadsheet is recommended for real estate investors who plan to buy and hold rental property. It provides a deep level of analysis with first year and 10-year holding period considerations.

The spreadsheet gives novice investors an easy and affordable way to know whether a real estate rental investment income property will be profitable before they put their money in.

Things You Can Do

Cash flow projections

See how changes in rents or expenses affect your profitability

Discover your tax benefit or loss

Determine your return on equity

See if your investment goals are met

Calculate an optimal offer price

Compare several investing opportunities

This is an Excel spreadsheet; it will work with Excel 2003, 2007, 2010 and 2013.

Item shipped on CD-Rom.